09

JANUARY, 2017

OPTIONS PINNING

RULES

TRADE MANAGEMENT

Happy New Year everyone,

In the first blog entry for this year we are going to explore a new type of trade “PINNING”. I have not done this trade more than 5 times so I certainly don’t consider myself an expert but it is a trade I would like to explore.

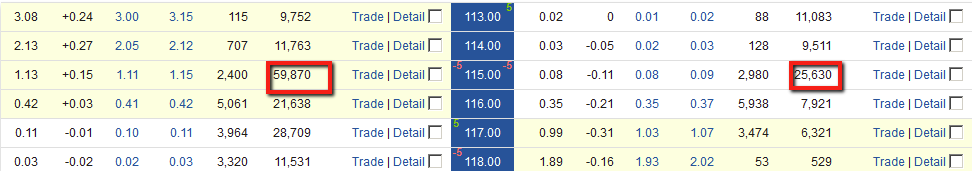

In the option world there is a concept called “pinning.” Normally, pinning takes place on the regular monthly option expiration (not the weeklies). And my guess is that this type of trade worked better when there was less computer trading with algorithms moving stocks to their destinations vs. the market makers but I will show you what I mean. The theory behind “pinning” is that the market makers want the stock to land at the strike with the greatest open interest forcing the greatest number of players to close positions on both sides of the trade – the puts and the calls. So to find a stock where pinning might be in play look for one where there is huge open interest at one strike and very little at other strikes nearby. Here is an example from $AAPL at the Dec. expiration cycle.

Notice there were 85,500 contracts at the 115 strike and for the other strikes shown nowhere close to that. Based on that information we decided to sell an Iron fly. We did this one week before expiration on 12/9. One of our room members Admiral suggested this trade. He did a 5 wide spread I did a 2 wide spread. I do think 5 wide works better. $AAPL closed on 12/9 at 113.95. So my Iron fly was 113/115 put credit spread and 115/117 call credit spread for a total of $1.40. So on a 2 pt. spread I took in $1.40 credit. My max. loss was .60 cents per contract. The good thing about this type of trade is that it has a good risk/reward ratio. I was risking .60 to make 1.40. It may not be a “high” probability type trade but you can be wrong fairly often and still make money. In this particular example I was wrong but still made money. $AAPL closed 12/16 at 115.97. So I had to buy to close the short calls for about .95 cents. The end result was that I made $.45 cents per contract. Not bad considering it didn’t pin at 115.

TESLA $TSLA Chart and the “PINNING” Trade

$JPM was the third trade and again it was done the day before expiration. Admiral simply did a call credit spread and $JPM did pin and he kept the majority of his credit.

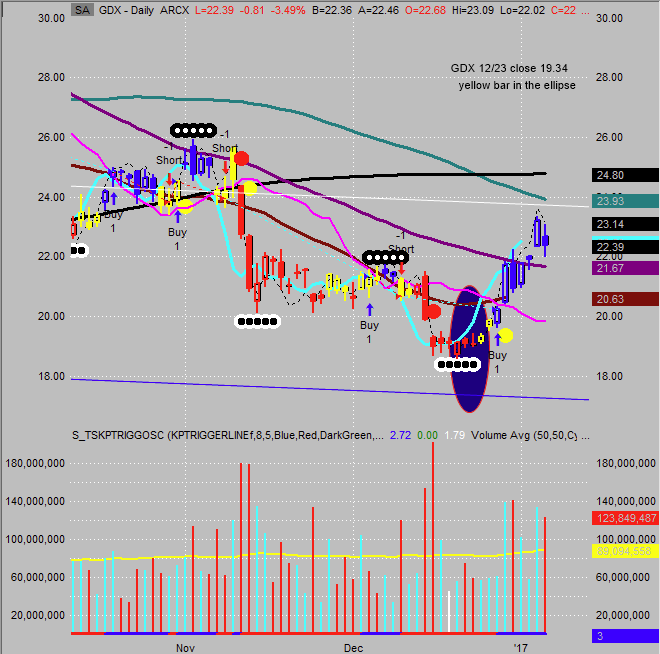

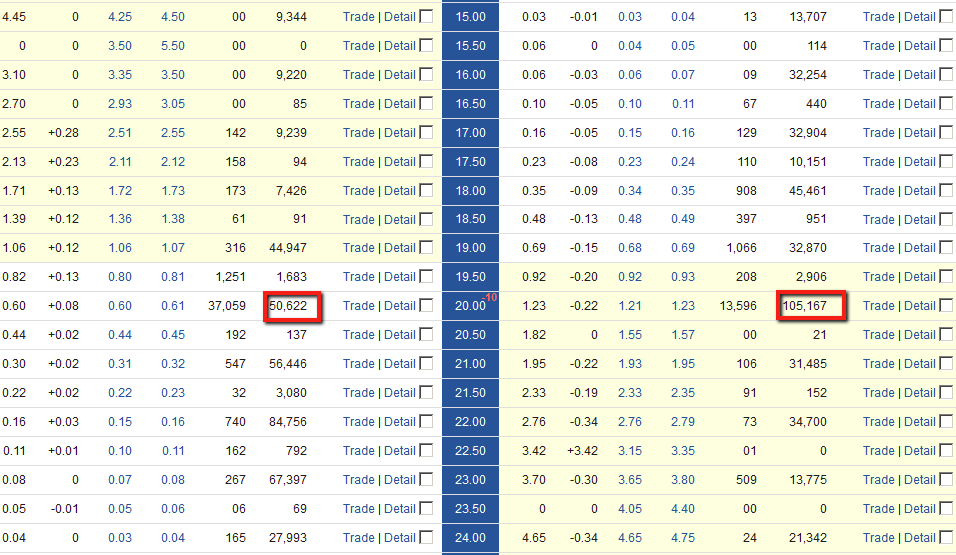

This was the $GDX Option Chain on 12/23/2016

It traded 50,000 contracts at that strike on that day. So we did an Iron Fly. We sold a 18/20 put credit spread and a 20/22 call credit spread. I received approx. $1.27 including commissions. This trade is currently under water because GDX overshot to the upside. However, there is still time for GDX to come back in and there is still time to adjust. If I were to adjust I would probably sell a higher strike put and take in more credit and then roll the put if I needed to. Right now, I’m waiting.

In general, pinning trades are not really chart based trades but trades based more on what you see in the option chain – large volume, unusual activity. However, that said, if the stock is sitting on a 200 day moving average or a 50 simple moving average is nearby or the stock is close to a nice round number like 100 or 200 that might lend credence to the pinning.

Because of the high risk vs. reward this trade offers I plan to look for more of this type of trade this year. One word of caution. You absolutely must close the short strike in the middle if it is ITM or you could be put stock (either short or long). This is unless the whole spread is blown out ie. past your long strike also then you can let the whole thing go through expiration at the max. loss.

Also, I had heard of “pinning” but hadn’t practiced it for awhile until another trader came to our room and started suggesting the trade. So thank you Admiral. I have extra $$ because you shared your ideas. And for anyone looking for trade ideas or sharing thoughts about trades our room is a great place to find that. www.seekingoptions.com. Until next week,

“Success consists of going from failure to failure without loss of enthusiasm.”

– Winston Churchill

JOIN OUR CLUB

TRY THE INCOME TRADES

#DOODLES_TRADES