18

DECEMBER, 2016

OPTIONS

Rules

Trade Management

Welcome everyone to a new trading blog we are calling Doodle’s. I am an option trader with 20 years of experience in trading options.

Often you can find a newsletter or a trading room that will help you get into a trade and this is awesome when it works. But, they aren’t so good at helping you manage a trade that may not have worked as well as you wanted. So this blog is an attempt to give you some ideas about managing a “difficult” trade.

In general I prefer selling option premium vs. buying it. So that means I sell calls and puts (trade them short) vs. buying them. So I normally take a credit from the market vs. paying the market money to put on a trade.

I am part of a group of traders at www.seekingoptions.com over the past 6 years we have been sharing trade ideas and learn a lot about trade mechanics – i highly recommend joining this group and be part of the club.

Today I will be presenting a trade that I took in one of my accounts, this trade was an idea suggested from another fellow trader. Before I dive into the trade mechanics, I have to address couple of very basic rules with respect to trading options.

- If you are trading equities know when the earnings releases are and if this will impact your option trade.

- Know When your option expires. Don’t guess.

- I plan to write up a trade once a week to share with everyone on lessons learned

Here is Today’s Trade:

TRADE: On October, 27, 2016 – I Sold the 33 Strike Put and the 41 Strike Call for the Dec. 16 Expiration cycle, with IV: 35%

TARGET: The normal goal with this type of trade is to close the position when it reaches 50% profit.

CREDIT: Received $0.95 credit per contract for this trade.

You can see on the chart the 33 level was about where the 200 Simple Moving Average (SMA) was and the 41 was above this year’s high at the time. $XOP was trading at 36.81. So this trade seemed reasonable to me. $XOP is a S & P Oil and Gas Producers ETF in case you aren’t familiar with it. And the volatility was around 35% at the time we entered this trade so that wasn’t super exciting.

How do you actually make money with this STRANGLE?

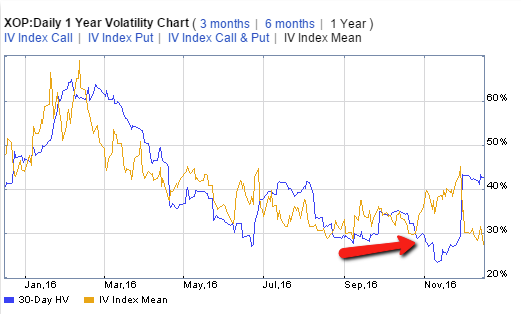

One is through time decay and the other is through volatility going down vs. up. In this case you can see volatility went completely the wrong direction. It went higher vs. lower. There was a very short period of time where this trade was up maybe .10 but overall it was in a losing position for most of the past two months.

Doodles Method on STRANGLES!

One thing I have learned with strangles is that I’m usually “right” and it is wrong to exit the trade early. If I can adjust or add a fly to control risk or just sit on my hands they usually will work in the end. This is probably more psychologically difficult than “cutting your losers short” but I simply hate losing. After all, why should oil rally 12-15% or whatever it has done in the last month? Has the world really changed that much?

I didn’t really get nervous until it broke above my 41 strike on 11/30/16. This coincided with OPEC announcing a meeting where they were going to cut production and get everyone to agree to that. This of course caused oil to go even higher. By 12/2 I could see that XOP wasn’t going to come down so I rolled my 33 puts and sold some 39 puts to take in more premium. So now I had a 39/41 strangle. This resulted in me taking in an extra .27 cents per contract

I held these contracts until expiration today on 12/16/16. During the day XOP dipped below 42 and I was able to close the calls for .80 cents per contract. Had XOP not pulled back today I was prepared to roll those calls to another expiration or simply take a loss. In this case I was able to actually make a small profit on this trade because I rolled the puts up and took in more premium, and XOP actually pulled back close to my upper strike.

“A trading plan is just words until you act on it.”

LESSONS LEARNED: I probably won’t trade XOP again simply because oil, which is the underlying, is too volatile. And because of this volatility does not “come in” on this product but stays constantly relatively high. There are simply too many extrinsic factors affecting oil the commodity which is then reflected in the oil stocks. Next time I will trade something simpler. And if you look closely at the volatility chart for XOP where the red arrow is pointing you can see the move higher in volatility which was just a killer for this trade.

TRADE IDEA: If you liked how we managed the above trade, i am looking for about two weeks out maybe longer and sell $GDX 18.50 puts for .50 cents or more. Or do a put 1 x 2 ratio trade to cut margin. In this trade you buy 1 contract and then sell 2 at the next strike lower. (This trade may need to be rolled but GDX will not go to 0).

Trade Details will be Posted in the #Doodles_trade Channel in our Chat Room

Happy Trading…

Doodles

JOIN OUR CLUB

TRY THE INCOME TRADES

#DOODLES_TRADES